Are you ready to grow up your business? Contact Us

Call us anytime

Are you ready to grow up your business? Contact Us

CMS reimbursement rules are not just administrative updates; they directly influence how much a medical practice earns, how quickly payments arrive, and how exposed the practice is to audits or clawbacks. As CMS moves toward stricter documentation standards, expanded value-based care models, and tighter utilization controls in 2026, physicians are right to ask one critical question: Will my revenue remain stable under these changes?

This 2026 CMS reimbursement checklist is designed to answer that question clearly. It walks physicians through what CMS is changing, why reimbursement risk is increasing, and what practical actions medical practices must take to protect revenue before payment issues begin to appear.

In previous years, many CMS changes affected billing teams more than physicians. That is no longer the case. In 2026, reimbursement is tied more closely than ever to documentation quality, coding accuracy, care complexity, and prior authorization compliance. Even small gaps can trigger delayed payments, underpayments, or post-payment audits.

CMS is also relying more heavily on data-driven oversight. Claims are now evaluated using automated systems that compare provider behavior to national benchmarks. When reimbursement patterns appear inconsistent, claims may be flagged even when no intentional errors exist. This means revenue risk is no longer limited to high-volume practices or specialty clinics; it applies to every provider billing Medicare.

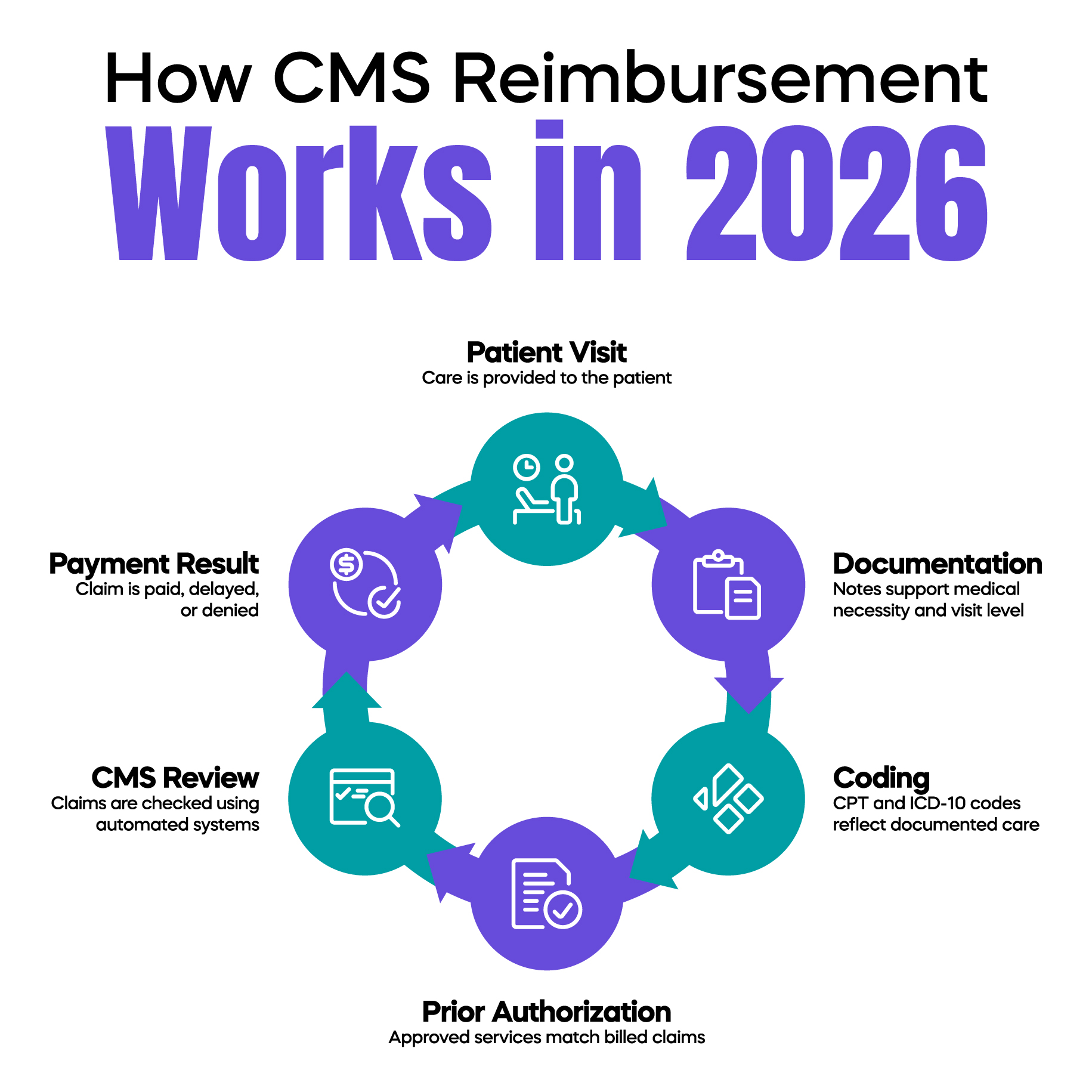

CMS reimbursement is calculated using a combination of relative value units, conversion factors, coding accuracy, and policy adjustments. In 2026, CMS places greater emphasis on whether the documentation supports the billed service rather than how frequently a service is billed.

Evaluation and Management services continue to play a central role in physician reimbursement. CMS expects time-based billing and medical decision-making levels to be clearly supported by clinical notes. Insufficient justification can result in downcoding or outright denial, even when the visit itself was medically appropriate.

Additionally, CMS is expanding its oversight of ancillary services, chronic care management, and preventive services. Reimbursement is increasingly tied to whether services align with updated coverage criteria and patient eligibility requirements.

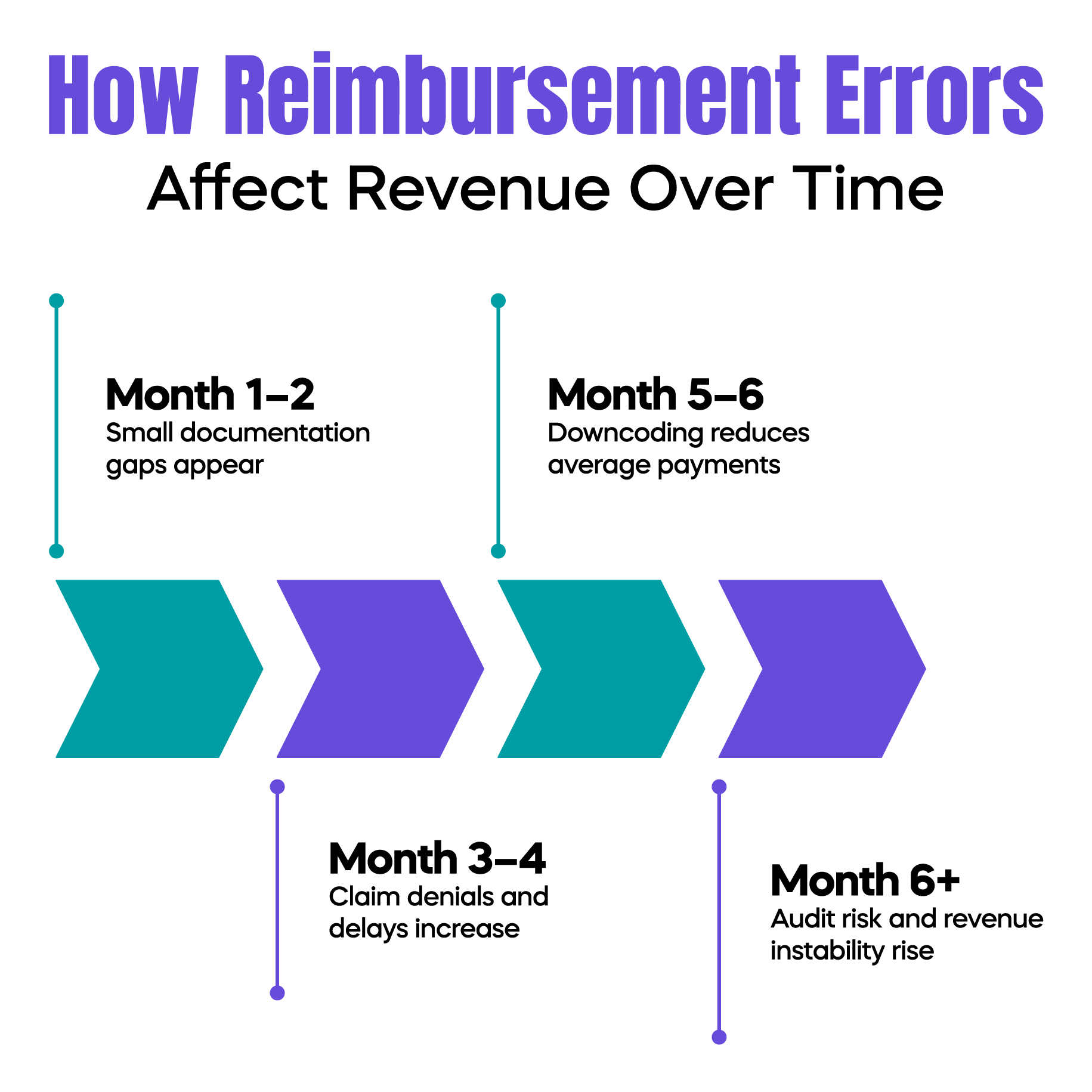

Many practices assume reimbursement problems are caused by payer behavior. In reality, most revenue loss stems from internal gaps. In 2026, the most common reimbursement risks include inconsistent E/M level selection, incomplete time documentation, outdated fee schedules, and poor alignment between diagnosis codes and billed procedures.

Another major risk involves prior authorization. CMS is coordinating reimbursement policies more closely with authorization requirements. When authorization data does not match the submitted claim, payments may be delayed or denied even if care was delivered correctly.

Value-based payment participation also introduces new complexity. Practices that do not actively track performance measures may experience reduced reimbursement without realizing why their payments are declining.

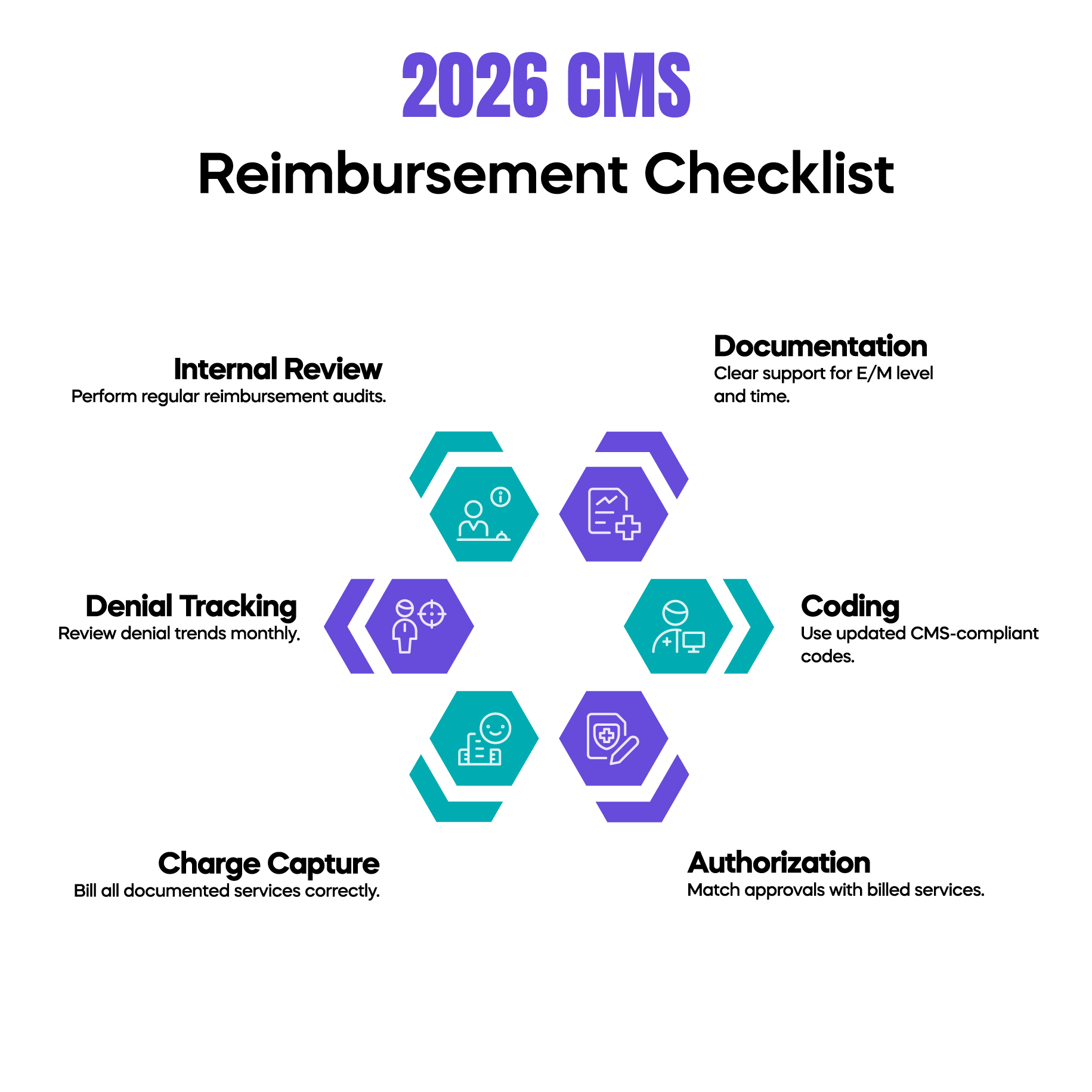

The first step in protecting revenue is ensuring that documentation consistently supports billed services. Every claim should tell a complete clinical story that justifies the level of care provided. In 2026, CMS reviewers expect clarity, not volume. Over-documentation does not improve reimbursement, but under-documentation increases audit risk.

Coding practices must also be reviewed regularly. Physicians should confirm that CPT and ICD-10 codes reflect current CMS guidance rather than legacy habits. Even small coding mismatches can affect reimbursement accuracy across hundreds of claims.

Practices must also align charge capture workflows with updated reimbursement rules. Services performed but not documented properly are unlikely to be reimbursed. Similarly, services documented without clear medical necessity may be downcoded.

Finally, practices should monitor denial patterns monthly. Reimbursement issues often appear gradually. Identifying trends early allows corrections before revenue loss becomes significant.

Prior authorization is no longer separate from the reimbursement strategy. In 2026, CMS increasingly evaluate whether authorized services align with billed claims. When authorization details are missing or inconsistent, payments may be held for review.

Practices must ensure that authorization approvals are accurately recorded and attached to claims when required. This is particularly important for imaging, procedures, and specialty referrals. Failure to manage authorization documentation properly can slow cash flow and increase administrative burden.

CMS continues to expand value-based care programs that tie reimbursement to quality metrics rather than service volume. Physicians participating in these models must understand how performance data affects payment adjustments.

Documentation must clearly reflect patient complexity, risk factors, and care coordination efforts. When patient acuity is underreported, reimbursement may not accurately reflect the resources used to provide care.

Practices should also confirm that quality reporting systems are capturing accurate data. Missing or incorrect submissions can result in reduced reimbursement even when clinical outcomes are strong.

Waiting for CMS feedback is no longer a safe strategy. Internal reimbursement audits allow practices to identify weaknesses before claims are reviewed externally. These audits should focus on high-impact services such as E/M visits, chronic care management, and procedures with frequent denials.

Audits also help practices understand whether reimbursement declines are caused by policy changes or internal errors. This distinction is critical for developing effective corrective action plans.

Billing MedTech works with medical practices to translate CMS reimbursement rules into practical workflows. Our approach focuses on aligning documentation, coding, and claim submission processes with CMS expectations so that physicians can focus on patient care without worrying about revenue instability.

By monitoring CMS updates, payer trends, and denial patterns, we help practices adapt before reimbursement issues escalate. This proactive approach reduces audit exposure and protects long-term financial performance.

CMS reimbursement in 2026 is directly influenced by how well a medical practice understands and implements broader CMS policy updates. Physicians evaluating their revenue risk should first understand how the 2026 CMS updates affect the medical billing bottom line, as reimbursement adjustments rarely occur in isolation. Applying a structured 2026 CMS checklist for profitable medical practices helps ensure that documentation, coding, and operational workflows remain aligned with payment rules. Reimbursement stability is also closely tied to audit preparedness, which is why following the 2026 CMS audit checklist to protect medical practice revenue is essential for minimizing payment disruptions. In addition, delayed or denied payments often stem from authorization gaps, making it critical to follow a reliable 2026 CMS prior authorization checklist for medical practices. Since E/M services remain the foundation of physician reimbursement, staying current with 2026 E/M coding and documentation changes for medical practices plays a central role in maintaining accurate payments and reducing compliance risk.

Arj Fatima is a U.S. medical billing and CMS compliance specialist with a strong focus on reimbursement accuracy, E/M coding standards, audit preparedness, and regulatory updates affecting physician practices. With practical experience translating complex CMS policies into clear, actionable guidance, Arj Fatima helps medical providers reduce billing risk, improve payment consistency, and stay compliant in an evolving Medicare landscape.

© Billing MedTech. All Rights Reserved