Are you ready to grow up your business? Contact Us

Call us anytime

Are you ready to grow up your business? Contact Us

Managing a radiology practice today means balancing high-volume diagnostic imaging with increasingly complex reimbursement rules. For physicians and practice owners, understanding how clinical documentation impacts coding, billing, and audits is crucial to protecting revenue.

Radiology billing and coding guidelines are not just administrative rules. They determine whether a claim is paid in full, down-coded, delayed, or flagged for audit. This guide explains how diagnostic radiology coding, documentation, and medical necessity work together across Medicare and commercial payers.

Diagnostic radiology coding relies on two core elements working together:

What service was performed, and why it was medically necessary.

CPT codes describe the imaging procedure itself, while ICD-10 diagnosis codes justify the clinical need for that procedure. Payers evaluate both simultaneously. When documentation fails to support the diagnosis-to-procedure link, reimbursement is reduced or denied.

Radiology services receive heightened scrutiny because imaging is costly and highly utilized. Even technically correct scans can be denied if documentation does not meet payer expectations.

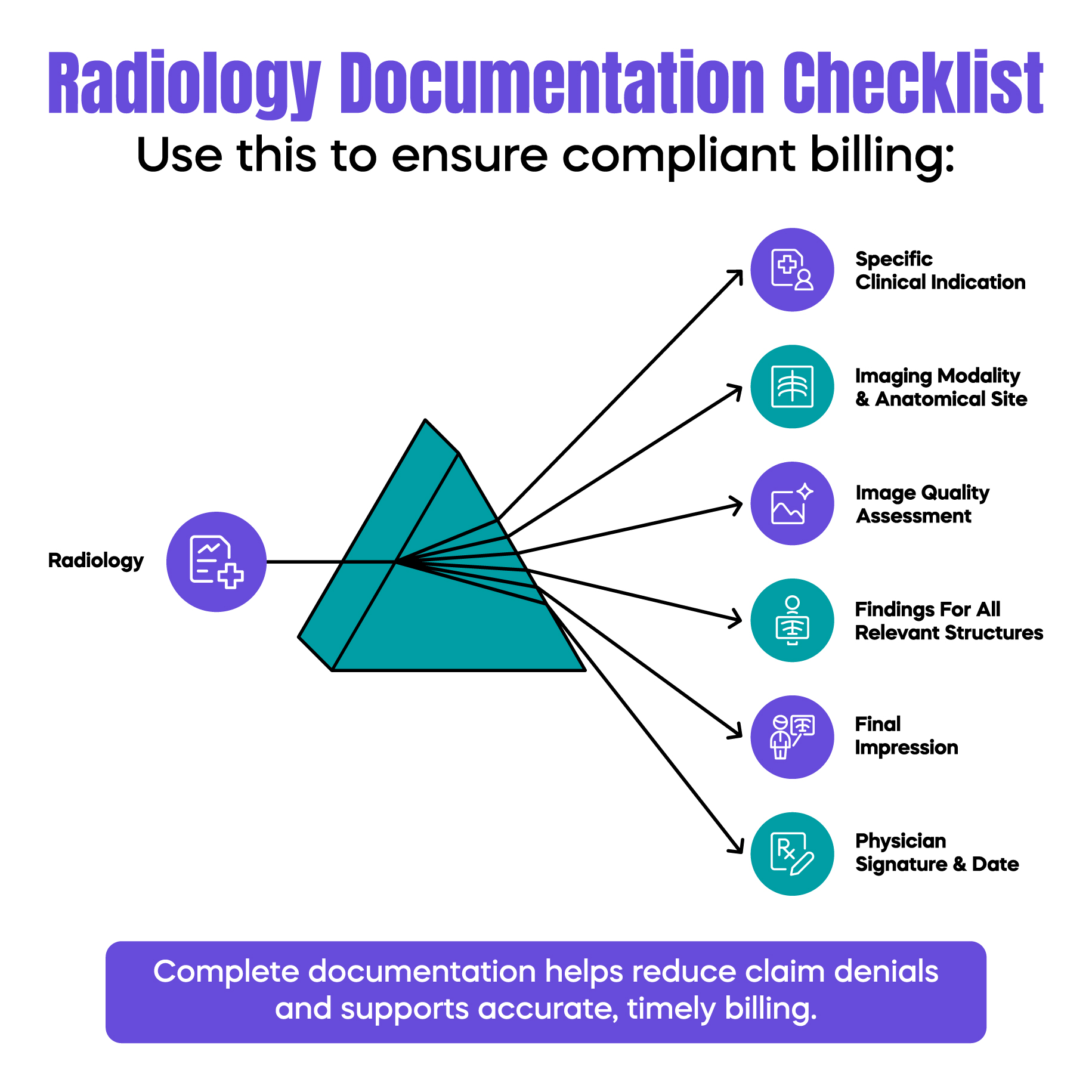

The radiology report is not only a clinical record. It is the primary financial document for imaging services. Under current radiology billing and coding guidelines, incomplete or vague reports can result in down-coding even when the scan was appropriate.

Documentation must clearly reflect:

Payers require a specific reason for the study. Documentation should move beyond general symptoms and clearly state the suspected condition.

For example, instead of documenting “abdominal pain,” a report should state:

“Acute right upper quadrant pain with suspected cholecystitis.”

This level of specificity supports accurate ICD-10 coding and strengthens medical necessity under both Medicare and commercial payer policies.

A common misconception is that normal imaging results require less detail. In reality, normal findings require complete documentation to justify the billed code.

If an abdominal ultrasound is billed as a complete study (CPT 76700), the report must document all required structures, even when unremarkable. Missing elements require down-coding to a limited study (CPT 76705), leading to immediate revenue loss.

This is one of the most frequent causes of silent underpayment in radiology practices.

Structured reporting and AI-assisted documentation are increasingly used to support compliance. These tools help ensure the required anatomical elements are consistently addressed.

However, AI does not replace a physician's responsibility. Radiologists must still verify that the documentation accurately reflects interpretation complexity and clinical judgment. Automated “no-touch” coding without physician oversight increases audit risk.

Radiology billing differs from most specialties because services may be split between interpretation and equipment ownership. Correct modifier usage is critical.

The professional component (modifier -26) represents the radiologist’s interpretation and report.

The technical component (modifier -TC) reflects equipment, supplies, and technologist costs.

When the same entity provides both components, global billing applies, and no modifier is used.

Misapplying these modifiers, especially in hospital-based settings, is a leading trigger for OIG audits. Always confirm the site of service and ownership structure before billing.

Radiology medical necessity guidelines determine whether imaging is considered reasonable and necessary. Medicare relies heavily on Local Coverage Determinations, while commercial payers apply proprietary clinical policies.

Both payer types evaluate:

Failure to meet these criteria results in denials, even when the imaging itself was technically correct.

Knowing how to document radiology medical necessity is critical for audit defense. Documentation should clearly explain the clinical question the imaging is intended to answer.

Diagnosis-to-procedure linkage must be logical and consistent across the medical record. Disconnected diagnoses are a common denial reason.

Radiology practices face increasing audit pressure due to real-time claim monitoring and zero-day denials.

Auditors commonly review:

Comparative analysis should be documented when applicable. If no prior study exists, the report should clearly state that no comparison was available.

For contrast-enhanced studies, the supervision level must be reflected in the record to support compliance.

Strong documentation and accurate coding directly improve revenue cycle performance. Clean claims reduce rework, shorten days in accounts receivable, and protect practices from unnecessary audits.

Modern radiology revenue cycle management uses predictive tools to identify documentation gaps before claims are submitted. This proactive approach prevents revenue leakage while maintaining compliance.

By aligning documentation with radiology billing and coding guidelines, practices can protect reimbursement and focus on delivering high-quality diagnostic care.

Arj Fatima is a U.S. medical billing and compliance specialist with deep expertise in radiology coding, documentation standards, and payer audit requirements. She helps radiology practices reduce denials, strengthen compliance, and build audit-ready billing workflows.

© Billing MedTech. All Rights Reserved