Are you ready to grow up your business? Contact Us

Call us anytime

Are you ready to grow up your business? Contact Us

The 2026 CMS E/M coding and documentation changes are not about learning an entirely new system. Instead, they are about tightening expectations, increasing enforcement, and ensuring that documentation truly supports the level of service billed. For physicians, this means clarity is critical. Misunderstandings, particularly regarding time-based billing and medical decision-making, can quietly erode revenue or lead to audits.

This guide is written to answer the questions doctors commonly have, without jargon, confusion, or unnecessary technical noise.

Many physicians wonder why CMS continues to adjust E/M guidelines when a major overhaul has already occurred. The answer lies in consistency and accountability. CMS data reveals ongoing discrepancies between the services documented and the levels billed, particularly in outpatient and specialty practices.

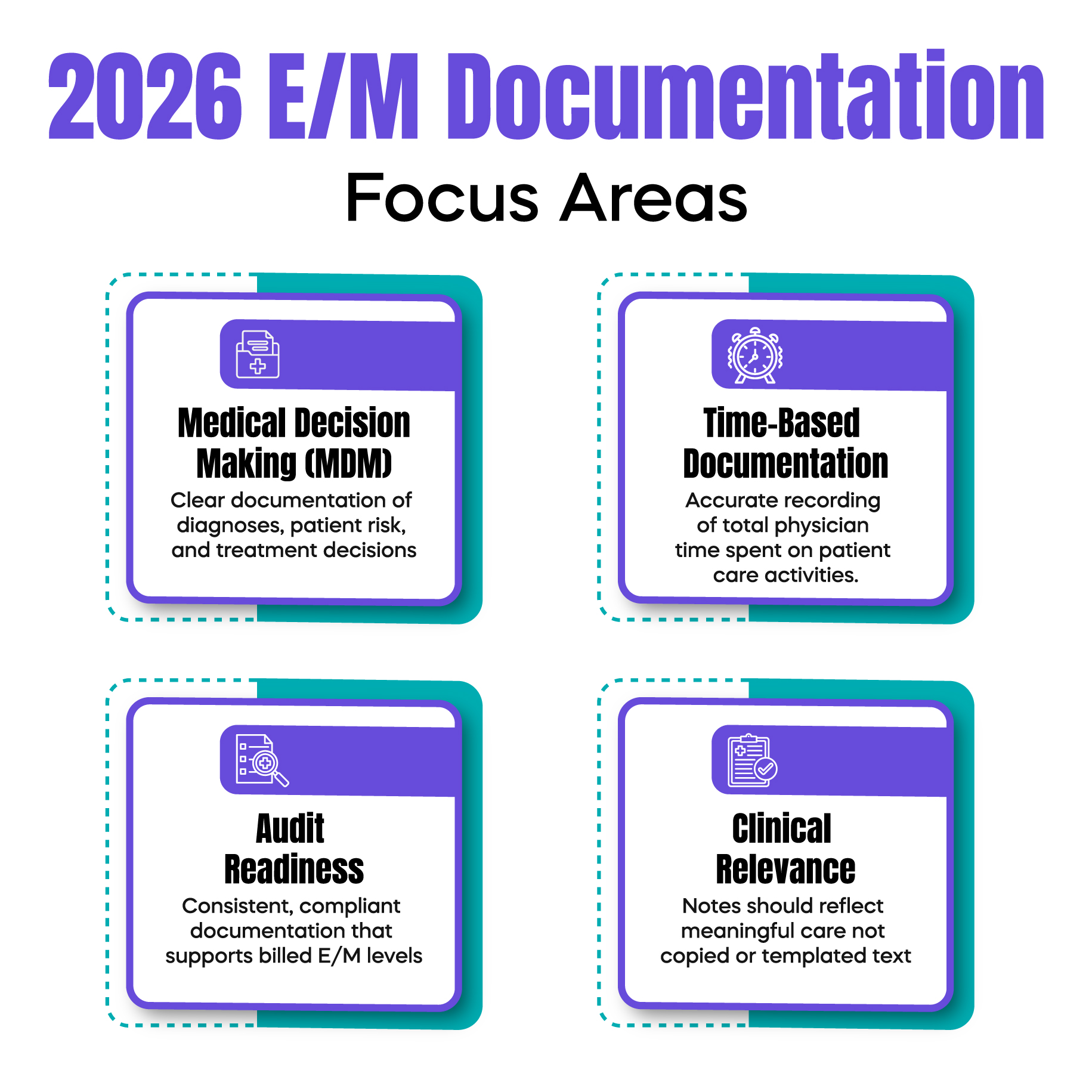

In 2026, CMS is focused on ensuring that E/M services accurately reflect patient complexity, rather than relying solely on documentation volume. The emphasis is no longer on how much was written, but on whether what was documented clearly supports the clinical story, decision-making, and time spent.

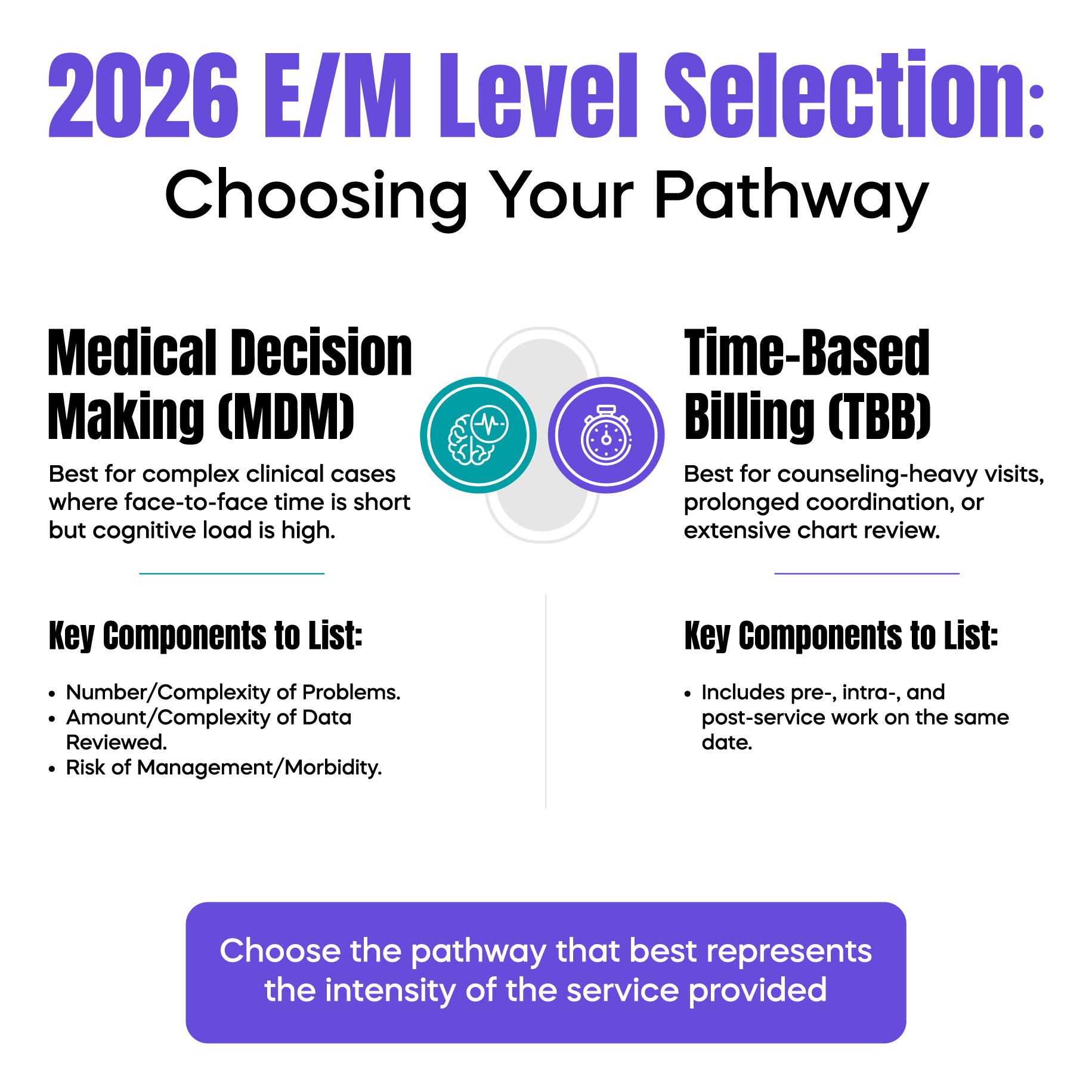

One of the most important clarifications in 2026 is that CMS now expects strict alignment between documentation and the chosen billing method. Physicians must clearly demonstrate whether they are billing based on medical decision-making (MDM) or total time, not a blend of both.

CMS has also strengthened guidance on what qualifies as billable time. Only a physician or a qualified healthcare professional who spent time on the date of service may be counted. Administrative tasks, staff time, and unrelated chart reviews are explicitly excluded. This clarification has direct implications for practices that rely heavily on time-based E/M billing.

Doctors often ask whether MDM requirements have changed again. The structure remains familiar, but CMS has raised expectations around clinical justification.

In 2026, auditors are paying closer attention to whether diagnoses are clearly addressed rather than merely listed. Each condition documented should demonstrate evaluation, management, or risk consideration. Additionally, CMS expects clearer connections between the data reviewed, patient risk, and treatment decisions.

Simply copying prior notes or listing stable conditions without explanation now carries a higher compliance risk.

Time-based billing continues to be allowed, but CMS is now far less forgiving about vague time statements. Phrases such as “spent over 30 minutes” without context may no longer be sufficient.

Physicians should document how time was spent in relation to patient care, such as counseling, care coordination, and clinical decision-making. The goal is transparency, not excessive detail. CMS wants to see that the time billed reflects meaningful physician involvement.

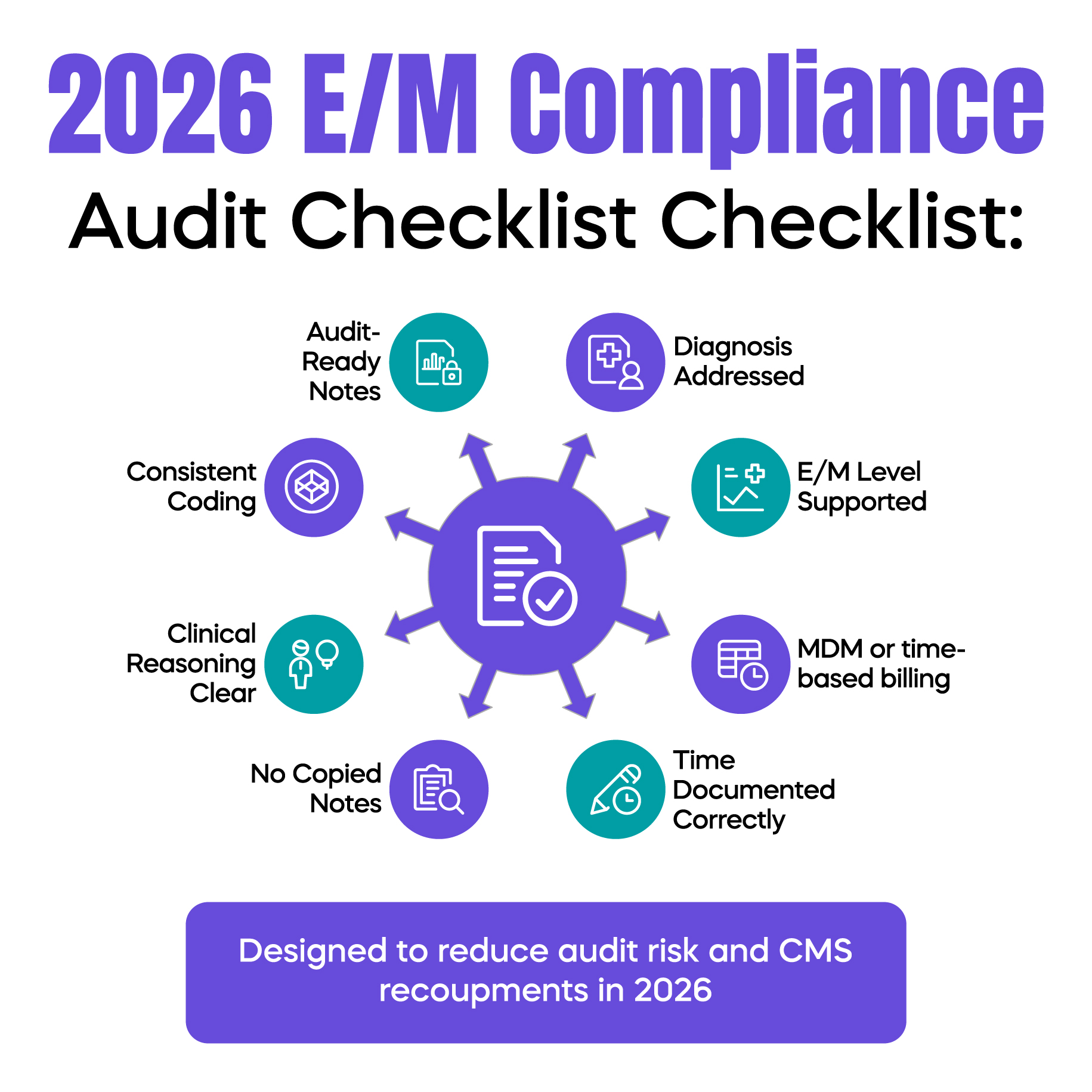

A common concern among doctors is whether these updates increase audit exposure. The reality is that inconsistent documentation is now a bigger risk than ever.

Practices with frequent level 4 and level 5 E/M claims, heavy time-based billing, or cloned documentation patterns are more likely to attract scrutiny. CMS and Medicare contractors are using analytics to identify billing behaviors that appear disconnected from documentation quality.

The good news is that compliant documentation does not require longer notes, just clearer ones.

Many physicians worry that tighter documentation standards mean reduced reimbursement. In practice, the opposite is often true. When E/M services are documented correctly, undercoding decreases, denied claims drop, and recoupments become less common.

Practices that proactively adjust workflows often find they can confidently bill appropriate levels without fear, protecting revenue rather than limiting it.

Preparation for 2026 E/M changes does not require overhauling your entire documentation system. It starts with understanding which billing method your providers use most often and ensuring documentation supports that choice consistently.

Internal chart reviews, focused provider education, and collaboration with experienced billing professionals can significantly reduce compliance risk while improving billing accuracy.

As CMS expectations evolve, relying solely on internal knowledge can leave gaps. Medical billing experts who stay current with CMS updates help practices interpret guidelines correctly, reduce audit exposure, and ensure documentation aligns with payer expectations.

Engaging experienced professionals for E/M coding oversight allows practices to operate with greater confidence and long-term financial security.

Written by a senior U.S. specialist in CMS reimbursement, audit preparedness, E/M coding accuracy, and revenue protection strategies for physicians and medical practices.

© Billing MedTech. All Rights Reserved